A prospectus is a document that outlines key information about ETFs and mutual funds, including investment objectives and fund managers. The Securities and Exchange Commission (SEC) requires that funds publish their expense ratios in their prospectus. You normally won’t be tasked with calculating expense ratios yourself, though, as they’re typically noted in fund documentation. Total Fund Expenses / Total Fund Assets Under Management = Expense Ratioįor example, if it costs $1 million to run a fund in a given year and that fund held $100 million in assets, its expense ratio would be 1%. How Expense Ratios Are CalculatedĮxpense ratios are calculated with the following equation: When you view the daily net asset value (NAV) or price for an index fund or ETF, the fund’s expense ratio is baked into the number you see.

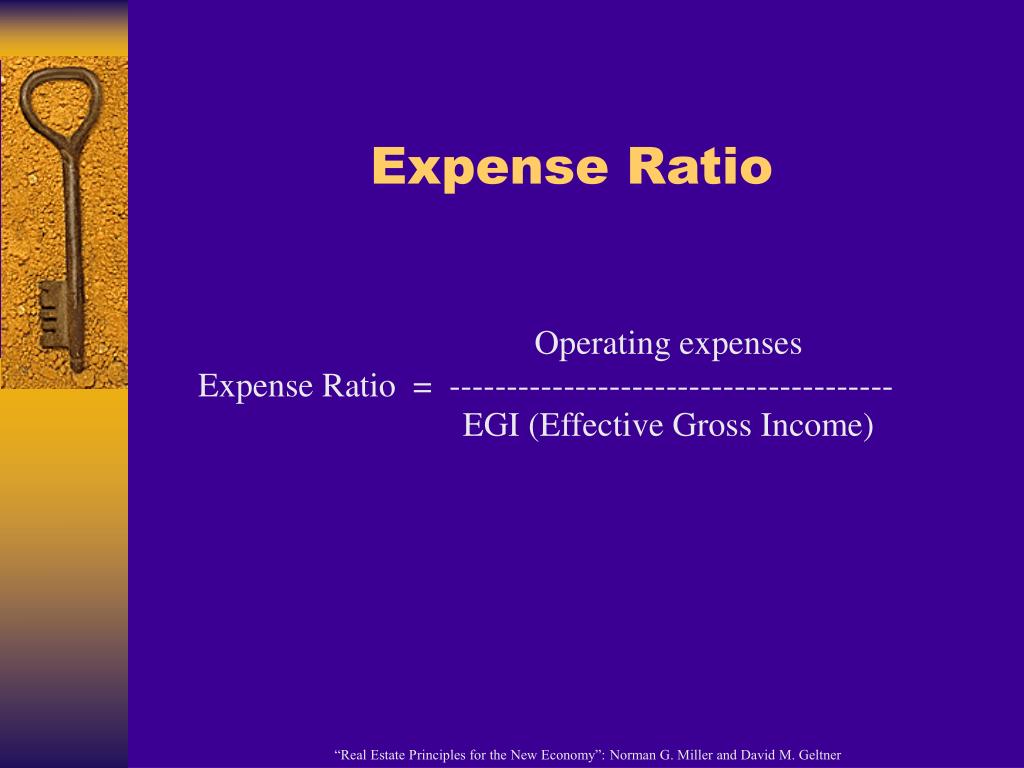

When you buy a fund, the expense ratio is automatically deducted from your returns. What’s important to note about all expense ratios is that you won’t receive a bill. At first glance, it might be hard to figure out how much that means you’ll pay each year, but Steve Sachs, Head of Capital Markets at Goldman Sachs Asset Management, says it’s easier to digest if you look at expense ratios in dollar amounts.įor example, if a fund had an annual expense ratio of 0.75%, it would cost “$7.50 for every $1,000 invested over the course of a year-that’s what you are paying a manager to manage a fund and provide you with the strategy you’re accessing,” Sachs says. How Expense Ratios Are ChargedĮxpense ratios are usually expressed as a percentage of your investment in a fund. If an actively managed fund employs high-profile managers with track records of success, you can expect it to charge a higher expense ratio.įor passively managed mutual funds and ETFs, which don’t actively select investments but instead aim to duplicate the performance of an index, the expense ratio covers things like licensing fees paid to major stock indexes-like S&P Dow Jones Indices for funds that track the S&P 500. This includes the labor involved in selecting and trading investments, rebalancing the portfolio, processing distributions and other tasks to keep the fund on track with its goals and purpose. “In the simplest terms, an expense ratio is a convenience fee for not having to pick and trade individual stocks yourself,” says Leighann Miko, certified financial planner (CFP) and founder of Equalis Financial.įor actively managed funds, the expense ratio compensates fund managers for overseeing the fund’s investments and managing the overall investment strategy. This article was originally published on Fool.Expense ratios cover the operating expenses of a mutual fund or ETF, including compensation for fund managers, administrative costs and marketing costs. The $16,728 Social Security Bonus You Cannot Afford to MissĢ0 of the Top Stocks to Buy (Including the Two Every Investor Should Own) For this reason, I always suggest making investment decisions with the gross expense ratio in mind. The gross expense ratio is how much you could pay. In short, the net expense ratio is how much investors are actually paying to invest in a fund. It reflects any temporary discounts - for example, if a fund's gross expense ratio is 1.00% and the managers agree to a temporary 10-basis-point fee reduction, it would have a net expense ratio of 0.90%.

This is why the net expense ratio is often lower than the gross expense ratio.

Many funds offer temporary fee waivers, or discounts, in order to attract investors. Here's where the net expense ratio comes in. This includes the fees paid to the fund's managers, administrative expenses such as office space and employee salaries, and other costs like marketing expenses. The gross expense ratio accounts for all of the expenses associated with a fund. Most of the time, the two numbers are the same.

However, mutual fund prospectuses generally include two expense ratios: the gross expense ratio and the net expense ratio.

0 kommentar(er)

0 kommentar(er)